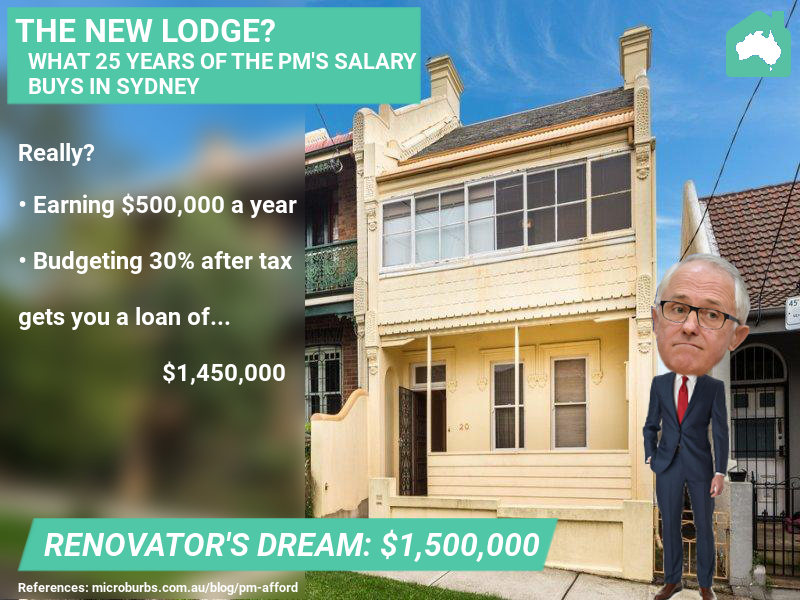

As property investors we all tolerate and enjoy some tired euphemisms. ‘Renovator’s Dream’, ‘Cosy’ and ‘Full of character’ have become old jokes as we wised up to them. At the same time though, we can unwittingly swallow a lot of nonsense fed to us by marketers, commentators and other investors. Some of these clichés have got under my skin recently and it’s time to give them a blast.

“Great for first-time investors”

This phrase implies that the property is not so great for seasoned investors. Would the real estate agent or developer advise against experienced buyers getting involved?

Not meaning to be rude sir, but you already have five properties, so this wouldn’t suit you. It would suit someone with less experience, a novice, …someone gullible perhaps.

Any property which is a good deal for a first time investor is an equally good prospect for an experienced investor. This phrase just gives the inexperienced an undue confidence boost.

“Are you negative gearing it?”

Gees I better check. Did I mismanage this property such that it is positively geared by mistake?

Dear tenant, it has come to my attention that your rent is so high that I have failed to ‘negatively gear’ this property, and I will need to reduce your rent.

First of all, nobody in their right mind sets out to negatively gear a property and is then surprised to find it’s not making them a loss after all. If this happens to you, congratulations! Add this positively geared property to your portfolio and go try again to buy something that loses money.

Second, the term applies to the outcome, not the strategy. You add up the income and subtract from that all the expenses and if the final number is negative, then the property is negatively geared. You don’t really make a management decision to “negatively gear it” – it comes out “negatively geared”.

“To be honest with you…”

“To be honest with you…”

Look, to be honest with you, I have several other interested parties who are ready to make an offer…

Should I be cautious of someone who qualifies a statement with, “To be honest with you…”? Does that mean every other statement they make without that qualification is dishonest?

At least it’s nice of them to let me know when they are telling the truth?

“Long term gainer”

Property has great long term prospects! (Don’t expect to make any money in the short term.)

How long is “long”? How long will I have to wait for that to come true and what happens in the meantime? What does this clairvoyant real estate agent know about the property market that I don’t?

This comment is a reflection of the agent’s opinion about short-term growth prospects – that they’re not great. After all, how can anyone truly know what will happen in the distant future to prices in any market? We may all be living in The Matrix and not even need properties in the future.

“This location will always be in demand”

Don’t be lured in by this phrase. It is technically correct but not helpful for investors.

There are locations that for a very long time have been highly prized by owner occupiers. These are the most expensive places to live in capital cities around the country. But merely wanting to own in such locations, doesn’t affect their prices.

A 14 year old boy will want a Ferrari for example, but that kind of demand doesn’t affect the price of Ferraris. The kind of demand we investors needto see is the kind of demand that actually affects prices, people bidding at auction, turning up to open homes and making offers.

This kind of demand is the very reason why I created the DSR score.

To cut through the euphemisms, get the facts on any property for free with a Microburbs report.

For press enquiries about this article, please call Microburbs Founder Luke Metcalfe on 0414 183 210.

* Data source: Every BBQ and dinner party you’ve ever been to

* Data source: Every BBQ and dinner party you’ve ever been to image:stonerealestate

image:stonerealestate